Existing Home Sales Stronger than Expected:

Existing-home sales grew for the second consecutive month in March according to the National Association of Realtors®. This report shows that home prices are rising, inventory levels are falling and the time a home is available for sale is dropping quickly. The trifecta of a strong housing market.

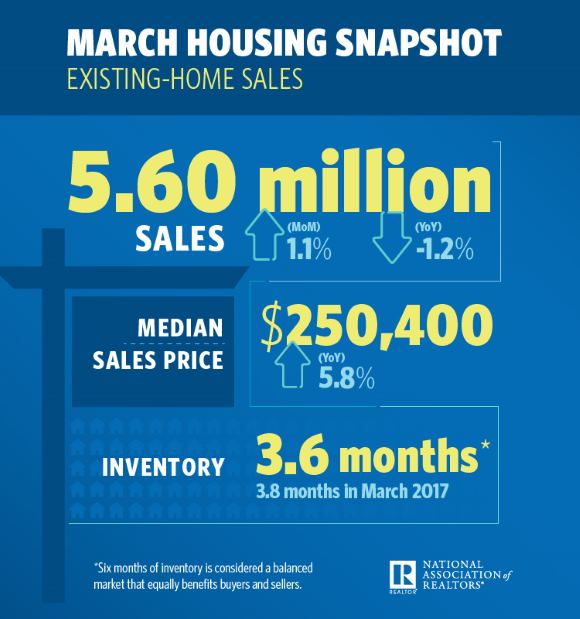

Total existing home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.1 percent to a seasonally adjusted annual rate of 5.60 million in March from 5.54 million in February. Economists had forecasted only a 0.2% gain.

Lawrence Yun, NAR chief economist, says closings in March eked forward despite challenging market conditions in most of the country. “Robust gains last month in the Northeast and Midwest – a reversal from the weather-impacted declines seen in February – helped overall sales activity rise to its strongest pace since last November at 5.72 million,” said Yun. “The unwelcoming news is that while the healthy economy is generating sustained interest in buying a home this spring, sales are lagging year ago levels because supply is woefully low and home prices keep climbing above what some would-be buyers can afford.”

The median existing-home price for all housing types in March was $250,400, up 5.8 percent from March 2017 ($236,600). March’s price increase marks the 73rd straight month of year-over-year gains.

“Although the strong job market and recent tax cuts are boosting the incomes of many households, speedy price growth is squeezing overall affordability in several markets – especially those out West,” said Yun.

Total housing inventory at the end of March climbed 5.7 percent to 1.67 million existing homes available for sale, but is still 7.2 percent lower than a year ago (1.80 million) and has fallen year-over-year for 34 consecutive months. Unsold inventory is at a 3.6-month supply at the current sales pace (3.8 months a year ago).

Properties typically stayed on the market for 30 days in March, which is down from 37 days in February and 34 days a year ago. Fifty percent of homes sold in March were on the market for less than a month.

“Realtors® throughout the country are seeing the seasonal ramp-up in buyer demand this spring but without the commensurate increase in new listings coming onto the market,” said Yun. “As a result, competition is swift and homes are going under contract in roughly a month, which is four days faster than last year and a remarkable 17 days faster than March 2016.”

Source: National Association of Realtors

What Happened to Rates Last Week?

Mortgage backed securities (FNMA 4.00 MBS) lost -54 basis points (BPS) from last Friday’s close which caused fixed mortgage rates to move higher for the week.

Overview: The threat of inflation continued to pressure MBS as we saw the worst levels in several years (highest mortgage rates in several years). CPI is back above 2.0%, Oil is up which is very inflationary (WTI 68.21, Brent 73.88), there is steady economic growth above 2%, the Fed is trimming down its colossal balance sheet and looks to hike at least two more times this year alone. That is the perfect petri dish for bonds to sell off.

Manufacturing: The Philly Fed Manufacturing Survey and Outlook came in better than expected, 23.2 vs est of 21.0. Prices paid jumped nearly 14 points to 56.4 for the highest reading in 7 years. And prices received jumped more than 9 points to 29.8 which is a 10-year high and an echo of yesterday’s Beige Book which said higher metal prices are being passed through, at least to some customers.

Industrial Production: Rose by 0.5% in March vs est of 0.4%, it was the largest gain in 6 years but much of that was due to energy production. Capacity Utilization improved by 78.0% vs est of 77.9%.

Retail Sales: The March Headline Retail Sales report was stronger than expected with a 0.6% vs 0.4% estimate. But when you strip out autos, Retail Sales matched expectations with a 0.2% reading. Department stores continue their free-fall but restaurants and furniture sales climbed higher.

The Talking Fed: The Beige Book was released (you can read it here.)

The main message in this report that is prepared exclusively for the May Fed meeting is “tariff”.

The word “tariff” appeared exactly zero times in the March Beige book that was used to raise rates at their April meeting. In this Beige Book, the word “tariff” is used 36 times!

– Outlooks remained positive, though contacts in various sectors including manufacturing, agriculture, and transportation expressed concern about the newly imposed or proposed tariffs.

– Inflation was seen as increasing but at a muted level, with prices increasing across all Districts, but at a moderate pace, although there were widespread reports that steel prices rose, sometimes dramatically, due to trade tensions. The Fed also notes that businesses generally anticipated further price increases in the months ahead, particularly for steel and building materials.

– Most Districts reported wage growth as only “modest” while reports of labor shortages over the reporting period were most often cited in high-skill positions, including engineering, information technology, and health care, as well as in construction and transportation.

What to Watch Out For This Week:

The above are the major economic reports that will hit the market this week. They each have the ability to affect the pricing of Mortgage Backed Securities and therefore, interest rates for Government and Conventional mortgages. I will be watching these reports closely for you and let you know if there are any big surprises.

It is virtually impossible for you to keep track of what is going on with the economy and other events that can impact the housing and mortgage markets. Just leave it to me, I monitor the live trading of Mortgage Backed Securities which are the only thing government and conventional mortgage rates are based upon.