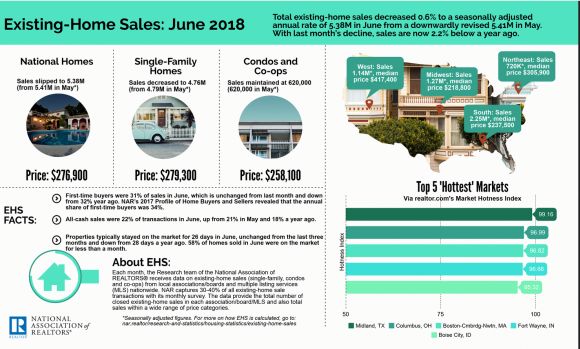

| The most recent Existing Home Sales data was just released by the National Association of Realtors and it showed a housing market that is still very strong.

Homes are being snapped up and at higher prices as properties typically stayed on the market for 26 days in June which is down from 28 days a year ago. Fifty-eight percent of homes sold in June were on the market for less than a month. The median existing-home price for all housing types in June was $276,900, surpassing last month as the new all-time high and up 5.2 percent from June 2017 ($263,300). June’s price increase marks the 76th straight month of year-over-year gains. Inventory is still very tight with the total housing inventory at the end of June hit 1.95 million existing homes available for sale, and is 0.5 percent above a year ago (1.94 million) – the first year-over-year increase since June 2015. Unsold inventory is at a 4.3-month supply at the current sales pace (4.2 months a year ago) which is well-below the 6 month supply level which is considered optimal. Lawrence Yun, Chief Economist at NAR, said “It’s important to note that despite the modest year-over-year rise in inventory, the current level is far from what’s needed to satisfy demand levels,” added Yun. “Furthermore, it remains to be seen if this modest increase will stick, given the fact that the robust economy is bringing more interested buyers into the market, and new home construction is failing to keep up.” “Realtors® throughout the country continue to stress that there’s considerable pent-up demand for buying a home among the millennial households in their market,” said Yun. “Unfortunately, they’re just not making meaningful ground, and continue to be held back by too few choices in their price range, and thereby missing out on homeownership and wealth gains.” What Happened to Rates Last Week?

|

| Mortgage backed securities (FNMA 4.50 MBS) lost -10 basis points (BPS) from last Friday’s close which caused fixed mortgage rates to move slightly higher for the week.

Overview: We had a very light week for economic data but we did get one major release (Retail Sales) which showed some real strength. The Federal Reserve got a lot of attention this week with two days of testimony by Fed Chair Powell and the Release of their Beige Book. The take-a-ways from the Fed and President Trump’s remarks are that the Fed is on track for potentially two more hikes this year. Retail Sales: The June data matched expectations with the headline reading hitting 0.5% vs est of 0.5%. The May reading was revised upward significantly from 0.8% to 1.3%. Same story when you strip out Autos. June was 0.4% vs est of 0.4% and May was revised upward from 0.9% to 1.4%. The Talking Fed: We had the Semi-Annual Monetary Policy Report testimony on Tuesday and Wednesday. The Beige Book, which is prepared specifically to be used at the next Fed meeting, was released -here are some highlights: 2 more rate hikes? President Trump is concerned that we will have two more rate hikes this year. And while the Fed has in fact indicated in their famous “dot plot” chart that two more hikes are to be expected, the markets have NOT been pricing in the second one yet. The third rate hike has been all but priced in but the 4th is not. So, does this mean that there is MORE of a chance of that 4th rate hike? |

| What to Watch Out For This Week:

It is virtually impossible for you to keep track of what is going on with the economy and other events that can impact the housing and mortgage markets. Just leave it to me, I monitor the live trading of Mortgage Backed Securities which are the only thing government and conventional mortgage rates are based upon. |